Michael Schinella Sr. and his son, Thomas, of United Properties in Fairfield, negotiated a lease with Panera Bread in hopes of convincing the national chain to open one of its Panera Café’s on property they own in Monroe. While trying to reel in a popular new tenant, the Schinellas told its executives about the town of Monroe’s commercial tax abatement program.

Panera Bread ultimately decided to open a new location at Town Line Plaza, 205 Monroe Turnpike, obtained all the necessary land use approvals, and went on to celebrate its grand opening with town officials and the Monroe Chamber of Commerce on December 14, 2022.

Last week, the Monroe Town Council unanimously approved the restaurant’s application for a commercial tax abatement on 20 percent of its assessment per year for seven years.

“Connecticut is a great place to do business in,” Michael Schinella said in a telephone interview Monday. “The problem is the net, net, nets — the cost paid over rent. We’re not talking electric and gas. It’s the taxes, insurance and grounds maintenance.”

Schinella said all those costs are borne by the tenant. When commercial Realtors discuss a property, he said the first thing developers ask is, “what are the net, net, nets?”

“Whatever we can save the tenant on the net, net, nets expenses, we try to do,” Schinella said.

The town of Monroe’s commercial tax abatement, which has been in place for decades, was revised over the years.

Among the businesses who took advantage of it is Victorinox. The international company most famous for its Swiss Army Knives relocated its U.S. headquarters from Shelton to 7 Victoria Drive in Monroe in 2007.

First Selectman Ken Kellogg praised Victorinox as a top taxpayer and employer, which offers high skilled jobs, boosting the local economy, while acting as a “wonderful corporate citizen” through its support of community causes.

The first selectman said some businesses have also taken advantage of the commercial tax abatement program to expand in Monroe, rather than move elsewhere.

Biomerics NLE, a vertically integrated medical device manufacturer, recently took over its entire building at 246 Main St., adding over 21,000 square feet to its space. The company submitted an application for a commercial tax abatement.

“We’re getting more now,” Kellogg said of businesses applying for abatements. “I think that’s a reflection of us bringing in more development. And if businesses need to expand, we’re encouraging them to stay in Monroe.”

How it works

“‘Why are you giving them a tax break?”” Kellogg said of a potential criticism of the program. “If the building sits there in its current state, the town isn’t getting anything incremental to improve that. Ultimately, the Council is abating that improvement. It should be seen as a win-win.”

The Commercial Tax Abatement Program is available for certain projects within a commercial or industrial district. This includes business, industrial and limited office and retail (LOR) zones. However, the first selectman said the program is not for home-based businesses.

Qualifying projects can range from a minimum of $25,000 worth of new construction or improvements to $10 million or more. The tiers are:

- Cost of improvements: $10 million plus, Abatement: up to 50% of the increased assessment, Term: up to 7 years

- $5 million plus, up to 30% of increased assessment, up to 7 years

- $3 million plus, up to 20% of increased assessment, 5 to 7 years

- $500,000 plus, up to 30% of increased assessment, up to 3 years

- $100,000 plus, up to 20% of increased assessment, up to 3 years

- $25,000 plus, up to 50% of increased assessment, up to 3 years

Assessments are based on 70 percent of a property’s fair market value.

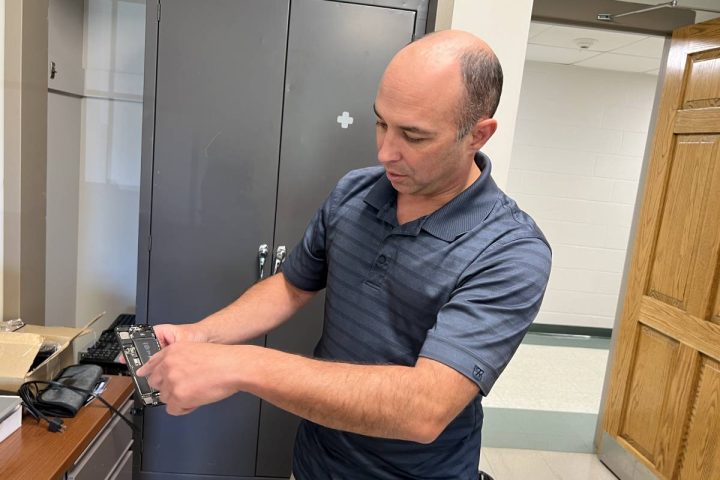

“The town is no worse off after than before the abatement, because it is based on the increase of the assessment as the result of the cost of improvements,” said William Holsworth, the town’s director of Community and Economic Development.

Holsworth receives applications for the program at his office at Monroe Town Hall. Then applications are reviewed by the Tax Incentive Program Review Committee.

The committee includes the first selectman, Finance Director Ronald Bunovsky Jr., Assessor Justin Feldman and a member of the Monroe Economic Development Commission, which is currently its chairman Ray Giovanni. Holsworth attends the meetings as a staff member, but does not have a vote.

The committee reviews applications against the Town Ordinance, while ensuring there are no zoning issues, violations or inconsistencies, that the building permit and certificate of occupancy are in order, and all taxes are paid and current.

The applicant, whether it’s the landlord, tenant or both, must prove all of the expenses were paid for construction. If tenants apply on their own, they must demonstrate that their lease makes the costs flow to them, according to Kellogg.

He said landlords and tenants usually apply together, adding both are interviewed to verify information during the process.

There is a maximum of 30 days to review an application before it moves to the Town Council’s Legislative and Administrative Committee for its review.

After it appears on the Council’s agenda it has 60 days to act. If it receives a recommendation from L&A, it moves to the full Town Council, which is required to hold a public hearing before a vote.

Kellogg said the Town Council has discretion to approve, approve with modifications or conditions, or deny an application.

According to the program, “all agreements shall contain a provision that any applicant granted a tax abatement shall pay the Town of Monroe the dollar amount abated plus interest if the business leaves Monroe before the time the abatement agreement ends.”

If a businesses is still in town when their agreement expires, it does not have to pay the town for the abatement.

Kellogg said he has not seen a problem of businesses taking advantage of the abatement program, then leaving town for a better deal after it expires.

If that ever does happen, Kellogg said the town is still providing an incentive for new construction, the Real Estate improvements remain taxable and the vacancy will eventually be filled.

“There is value to encourage new construction regardless,” he said. “If a property owner wants to improve their property by investing in it, we want to encourage that.”

“If more people take advantage of that, that would be great,” Giovanni added.

A balancing act

The Commercial Tax Abatement Program is currently being reviewed by Town Attorney Frank Lieto, according to Kellogg, who said he believes revisions need to be made.

For example, businesses can apply for a commercial abatement within six months of receiving a certificate of occupancy. “I would like them to be able to apply before a project,” Kellogg said. “If you’re trying to be competitive in attracting someone to town, you have to have that flexibility.”

Holsworth said that change would incentivize desirable businesses up front to come to Monroe.

“We do want to reassess the thresholds of the abatements the town can award,” Kellogg added.

The purpose of growing the grand list is to increase commercial tax revenue and ease the burden on residential taxpayers. Kellogg said officials must strike a balance, so the amount of abatements awarded does not impede that goal.

“You don’t want to undermine that. You have to balance it out,” he said. “You want to provide that incentive, while taking a longer term view of it.”

Schinella said making the thresholds of what an applicant has to spend on a property a little lower would help more mom and pops to participate.

Another modification to the program Kellogg said the town should consider is giving the Town Council full discretion over how much of an abatement is allowed, which would enable members to consider other factors of an application, such as the kinds of jobs a project would bring to the community or whether it includes environmentally friendly green improvements.

‘Monroe means business’

The first selectman said commercial tax abatements are just “one tool in the tool box for economic development”.

“I think it’s helped incrementally,” Kellogg said of the program. “We have businesses that take advantage of it, so it must have been important to them. I certainly think it has had an impact.”

When it comes to growing the grand list, he said the most important thing is creating the right environment, from the zoning regulations the Planning and Zoning Commission adopts to how town staff treats those interested in investing in the town.

Once big name brands choose to come to Monroe, Holsworth said others notice and more developments follow.

Years ago, Kellogg said Monroe had a reputation among commercial brokers of being a difficult place to do business in.

“I think this turned that around,” he said of the town’s efforts to change the environment. “A prominent commercial broker said, ‘he’s not kidding. Monroe is open for business.'”

Giovanni said he has heard similar sentiments from developers, along with praise for Monroe’s new chief building official, John J. Morris Jr.

Schinella praised the work of Kellogg, Schultz and the Planning and Zoning Commission, as well as Holsworth and Feldman, who he said were “hands on” while helping he and his son apply for the abatement.

“We have space for two more tenants, one is Aldi,” Schinella said. “Their first question was, ‘how cooperative is the town.’ I said, ‘highly cooperative. The town of Monroe is great to work with.’ Then they asked, ‘do they help with the tax situation?'”

Schinella told them about the commercial tax abatement program. He recalled how much Panera’s executives appreciated it.

“I can’t tell you how important it was for the Schinellas to share it with our tenant, Panera,” Schinella said. “That’s why we’ve got to give Monroe a big bow and bouquet of flowers. This inventive program is great, because it shows they are working with the tenants.”

All respectful comments with the commenter’s first and last name are welcome.