MONROE, CT — Masuk High School junior Aidan Haughney landed a job as an auto mechanic with a starting salary of $48,000. He planned to move to Rotaryville and had to decide whether to buy a home or rent an apartment.

To cover the first month’s expenses, Haughney had to stretch his $4,000 monthly salary … well $3,074 after taxes, to buy a vehicle, gas, insurance, groceries, utilities, internet service and a phone, while still setting money aside for retirement and any unforeseen costs along the way.

Would there be enough money left at the end to give something to charity or to treat himself to entertainment or even a cup of coffee?

“I don’t drink coffee personally,” Haughney said of the latter option.

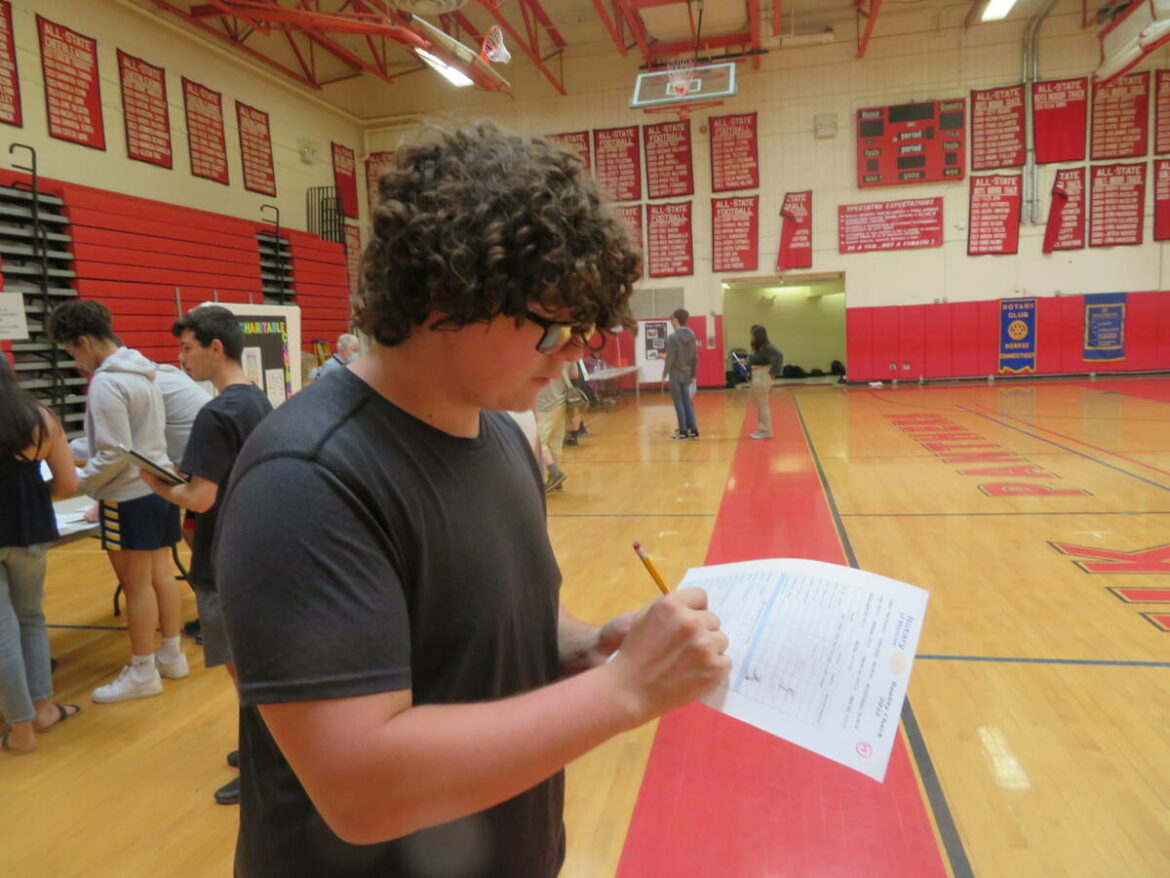

It was a real “Reality Check,” which also happens the name of the Rotary Club of Monroe’s finance and budgeting simulation held in the Masuk gymnasium Tuesday morning. Haughney was among the 100 students in teacher Jonelle DiSette’s personal finance class who participated.

Each student was assigned an occupation at random with an annual salary, a monthly salary and the net pay after taxes. Then they went around the room, stopping at tables to visit the businesses and services of “Rotaryville.”

Students had to go to the bank and buy things like housing, transportation and insurance with the goal of having money left over at the end of the month — when everyone had gone around the room.

There was even a spin of the Wheel of Fortune, or sometimes misfortune, where they could get more money or incur an unforeseen cost.

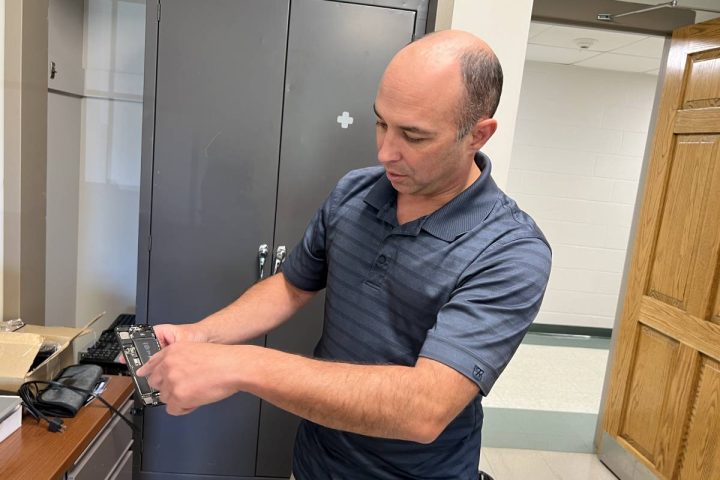

Volunteers, made up of business professionals, many of whom are Rotarians, manned the booths, presenting different options and answering questions.

Dave Wolfe, a Rotary Club member, modeled Reality Check after a program at the Yukon Public Schools in Oklahoma. He proposed offering the program at Masuk with the support of Superintendent of Schools Joseph Kobza, who can attest that the simulation was not easy.

When the Rotary Club did a dry run at the United Methodist Church of Monroe, Kobza was given the occupation of a plumber’s apprentice.

“I ran out of money after getting my housing, my insurance and my house,” Kobza said. “I was looking for a second job.”

The simulation includes the SOS booth, which offers financial aid to students who run out of money before the month is over. It usually results in them taking on a second job.

Kobza said, “I think it’s such a good experience for kids to go through this to see how far their money goes …”

“Or doesn’t go,” Assistant Superintendent Jack Ceccolini added.

DiSette said she used to take her students to financial reality fairs offered by credit unions, which were held at Housatonic Community College and Central Connecticut State University.

“With COVID it stopped and didn’t start up again,” she said of those events. Of Reality Check, DiSette said, “I am so excited to have this opportunity for our students this year. I didn’t think they would have the opportunity.”

Buy or rent?

Haughney had $2,000 in the bank and received his first paycheck, so with $5,074 in hand he explored Rotaryville’s housing options.

Cynthia Lucero, a Realtor with Higgins Group, explained the differences of buying a house, buying a condo and renting an apartment. For example, as a condo owner Haughney could avoid shoveling snow and mowing his lawn, but would be hit with association fees.

“So are you going to rent or are you going to buy?” Lucero asked.

“I’ll rent,” Haughney replied.

Walking away from the booth, he said, “it was the cheapest and I don’t need a house at the moment. It has the necessities. It has one bedroom and one bathroom — all I need. I’m one person.”

The cost: $1,075 a month, leaving Haughney with $3,999.

A little adds up

One goal of the exercise is to encourage students to start saving for retiring at a young age, because a little can add up to a lot over time.

For example, Wolfe said if a 25-year-old squirrels away $300 a month, putting it into a retirement fund, it could result in a savings of over $1 million by age 67.

That concept can also work against you, Wolfe warns.

“You might buy coffee and a doughnut and think, ‘no big deal,’ but it adds up,” he said.

Treating oneself a few times a week could cost up to $50 a month, compounding to $600 a year, according to Wolfe.

Medical insurance

Aline Nichols, a member of the Rotary Club in Cheshire who volunteered at the medical insurance booth, hopes to bring Reality Check to her town. She presented different options to Haughney, telling him how an accident could lead to a high medical bill, so insurance would give him peace of mind.

“In my occupation as an auto mechanic, things can happen, so it would probably be good to have,” Haughney reasoned.

“Nothing’s going to happen! You’re going to be fine,” Nichols encouraged Haughney after he made his purchase.

The cost was $200 a month, but Haughney later canceled the policy after realizing he can stay on his parents health insurance plan because he’s younger than age 26.

Good advice

Haughney wanted to buy a phone and TV, internet and wifi for his home and found a good deal after talking to Ronald Bellenot Sr., an attorney and a rotarian volunteering at the booth.

“I think because I have the money I will go with the most expensive phone and TV,” Haughney said.

However, Bellenot suggested buying the most expensive phone and a basic TV, then streaming his favorite programs to his TV.

“Do you watch more things on your phone? You could get the phone and internet and stream it to your TV,” he said. “You just saved a hundred bucks.”

Leaving the table, Haughney said, “I think what they recommended was definitely the right option.”

The cost: $133.22 a month.

Renters insurance

Haughney wanted to insure his apartment and learned how renters insurance provides protection for losses inside his unit, while his landlord is responsible for the outside.

“When you come in, you have your electronics, TV and clothes — that’s what you want to protect,” the volunteer told him. “If there’s a fire, you want to stay somewhere else. If you have friends at your apartment and someone trips and falls, you want insurance for your liability.”

“I’ll take the minimum policy,” Haughney said. “I like going out more than having people over. I don’t need as much for liability.”

The minimal policy cost $11.12 a month, rather than the better policy at $43.62 a month. “The minimal was good for my personal items,” Haughney said. “I don’t have as much to require the maximum.”

Student loan, retirement savings

Haughney stopped at the bank and decided to pay $102.57 per month for his student loan and to put $200 aside for retirement.

He crunched numbers on the calculator on his phone and found he was still in good shape, before shopping for transportation. Haughney’s choices included a Honda Civic, CRV or Ridgeline.

“I have some used cars and some new cars,” said Wendy Rooney. “Do you want new or used?”

“I’ll probably go with the Civic,” Haughney said. “It has the cheapest payment and cost for gas.” Looking up at the women volunteering at the booth, he smiled adding, “personally, I would probably not be this responsible.”

The women laughed.

The used Honda Civic cost $186.02 a month and $116.10 for gas.

What about food?

Haughney scanned the remaining booths inside the gym. “I’ll skip entertainment right now,” he said, before walking to the grocery table.

Students had a choice of supermarkets, each with different levels of pricing. Big Y, Caraluzzi’s Newtown Market and Whole Foods.

“I would probably go with Big Y,” Haughney said, “not just because it’s the cheapest, but I prefer it myself.”

The cost was $303 a month and he used a pencil to jot it down on his sheet.

“I think I’m gonna hit utilities,” Haughney said.

Utilities ran him $220 a month.

“Oh yeah, I’m doing pretty good,” he said, glancing at his sheet. Haughney had $2,526 and change left.

Auto insurance

Vincent Albaladejo explained the insurance options for Haughney’s Honda Civic, which included minimum coverage and a better, more expensive, policy.

“As much as I think I’m a good driver, you never know,” Haughney said after the transaction. “I got the better policy. It’s only $17 more, and with the amount of money I had left, I thought I’d be fine.”

His auto insurance cost $101.09 a month.

No whammies, no whammies …

Haughney tried his luck at the Wheel of Fortune, staffed by Rick Smith and Molly Simmons-Smith. Would he receive bonus money or an unexpected expense?

Here goes …

Ouch!

A $300 car tax.

“I have the worst luck,” Haughney said with a chuckle. “With all this, I’m still over $2,000, so I can probably go to entertainment. Now it’s reasonable. I probably have the money for it.”

He chose to spend $120 for dinner and a movie for two. “I’m for a nice quiet night out,” Haughney said.

Well, maybe iced coffee

Next, Haughney donated $15 to charity, then headed for the coffee shop.

“Do you drink coffee?” Johnny Viteri, a volunteer, asked.

“No.”

“So if you did drink coffee, where would you choose?” Viteri asked.

The choices were Dunkin’ Donuts, Starbucks and Last Drop Coffee Shop.

“I get iced coffee at Dunkin’ Donuts once in a while, not hot,” Haughney said of his decision to buy a coffee and a sandwich at the popular chain three times a week.

That cost just over $70 and Haughney finished the simulation with about $2,000 in his pocket.

“Oh my goodness,” Masuk Principal Steven Swensen said. “You don’t want to go back and do some upgrades?”

“I’m playing it safe,” Haughney replied.

“A very economical and conservative approach, but smart, especially when you’re starting out,” Swensen agreed.

“If anything, I would upgrade, probably my car,” Haughney said. “Everything else I think I’m fine and I’m fine with renting.”

Long term planning

Wolfe solicited feedback from students and volunteers in hopes of improving Reality Check and offering the simulation again next year.

“I think they did really well,” DiSette said of her students. “I think they realized how everything we do in class starts to fit together with the budgeting. I am so glad they did this.”

“Our Rotary members are such a great resource,” she continued. “They’re the experts. They’re the ones running these businesses, and hearing from them means a lot to the students. They’re having real conversations together.”