MONROE, CT — The Town Council on Tuesday set Oct. 23 as the date it will hold a public information meeting on several resolutions that would provide funding to pave roads, purchase Public Works equipment, make upgrades in three schools and for the purchase of St. Jude School to be converted into a community center and for municipal offices.

The $3 million cost for St. Jude’s, which includes the $1.7 million purchase price and funding for the first two phases of the renovation, would come from the town’s fund balance, while the other $2.9 million cost for the three municipal projects would be funded through bonding.

First Selectman Ken Kellogg made a presentation on the projects to the council and will make the same presentation to the public on Oct. 23 at 6 p.m. in the council chambers at Town Hall.

Of the bonded projects, $1,020,000 will go toward road construction and reconstruction, Kellogg said, which will be added to the money already budgeted for a total of $2.5 million.

Another $900,000 will go for improvements at three schools – Jockey Hollow Middle School, Fawn Hallow Elementary School and Stepney Elementary School. The plans include $75,000 for upgrades to door knobs and crash bars at Jockey Hollow; $375,000 to pave the front driveway and parking lot at Fawn Hallow, as well as $170,000 to replace exterior doors there, and $225,000 to replace the drop ceiling and hallway lights at Stepney, as well as $40,000 to replace the kitchen floor tiles there.

The remaining $1,030,000 is targeted for the purchase of several pieces of equipment for the Public Works Department, including $600,000 to replace two dump trucks; $98,000 for a Ford F550 truck with a plow and a spreader; $225,000 for a loader and $58,000 for a Ford Explorer.

The town is in a good position to both bond and spend from the fund balance, Kellogg said. The town’s debt remains at a manageable level even taking into consideration the additional $2.9 million that’s proposed for the projects, he said. Since 2015 its debt level has “significantly decreased,” he said, with its bonded debt per capita at about half of the state average.

“We have a healthy ability to take on debt,” Kellogg said.

The fund balance too is at a healthy level and even subtracting the $3 million for St. Judes still keeps it above the town’s target level, he said. That is a result of wise budgeting over the years, as well as greater than expected returns on investments, a high tax collection rate and more grant money than anticipated, and in particular the federal and state ARPA grants the town received during the pandemic.

The current unassigned fund balance of $24 million is the town’s highest fund balance ever, Kellogg said. The Board of Finance recommends that the fund contain at least two months of funding for town operations, which is less than the current fund balance. It also doesn’t include separate accounts of $1 million for unanticipated special education costs and $500,000 in a special fund for disasters like the pandemic.

The special education fund is especially important because of the unpredictability of those costs, Kellogg said. At any time a family could move into town with a child who qualifies for special education programs that can be budget busting, he said, and the town has no choice but to pay for them.

The finance board has said it supports the use of fund balance money for the St. Jude purchase, Kellogg said.

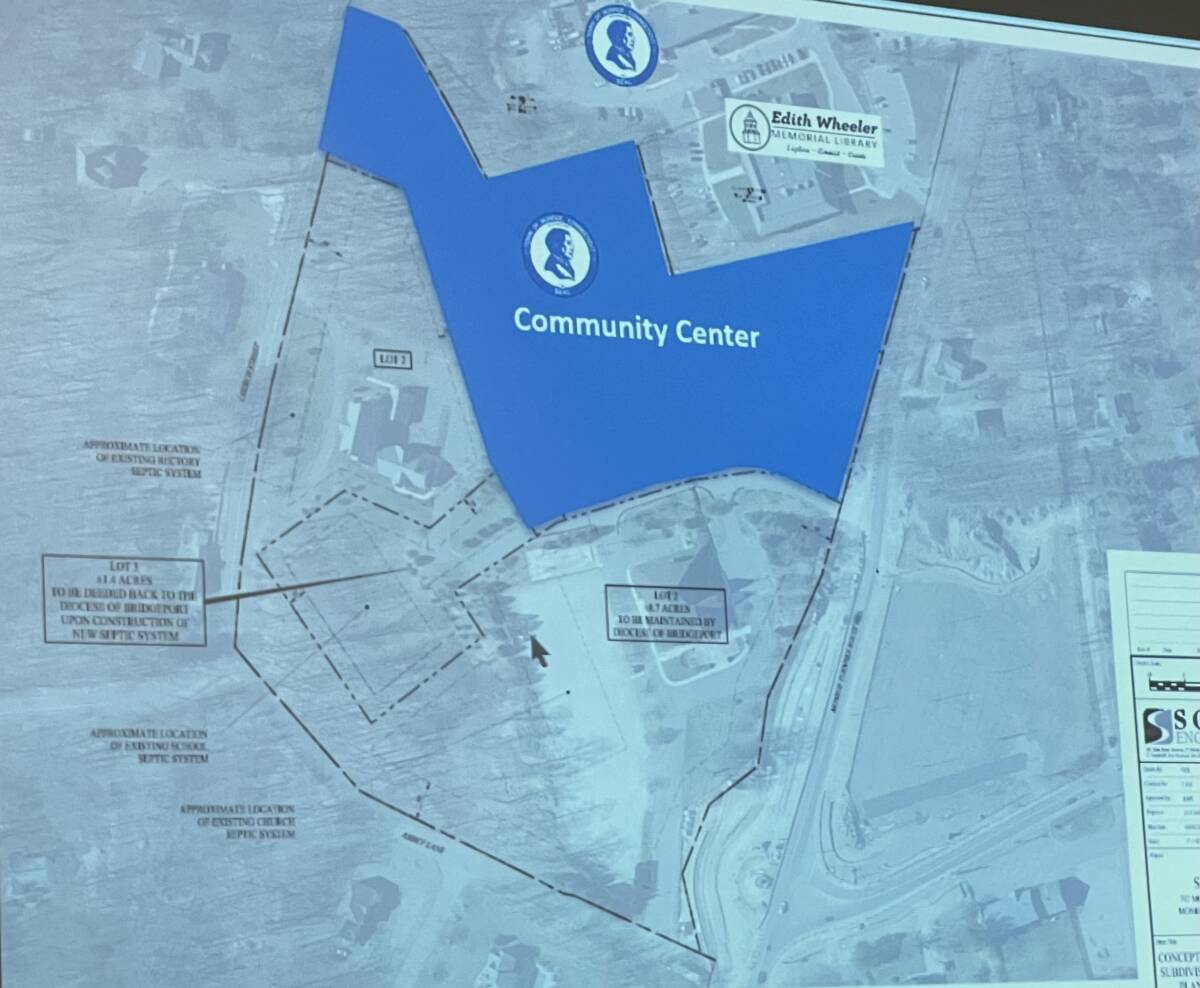

Of the $3 million allocated for the St. Jude purchase, $1,775,750 of it is for the purchase of the building and property made up of 6.2 acres. Initially it was thought the purchase price would be higher but was negotiated down based on the deferred maintenance that will be needed to the building, Kellogg said, such as a new roof.

When considering the purchase, the town also looked at the former Chalk Hill School building, he said, but that building is three times the size of St. Jude, which would result in much higher operating costs, and the cost to renovate also would be significantly higher. And the location of St. Jude, next to the public library and Town Hall, was an opportunity to expand the municipal “campus,” he said.

According to the agreement with St. Jude, it will retain the right to use second floor classrooms for a time after the sale, and until one of three conditions is met: either the town relocates the septic system to the building to separate it from the church building, after which the town will reconvey the existing septic system back to the church; the town provides the school 120 days notice to relocate its program, or 10 years from the date of the sale closing. St. Jude will continue to be able to use the parking lot on the property on weekends for parishioners to park during Masses.

During the first phase of the renovation project, the town will have the use of the gymnasium and the first floor of the school, which will be used for Parks and Recreation offices and children’s programming while code work is completed.

During the second phase, space also will be used by Community Services and the senior center as needed.

The third phase entails St. Jude vacating the second floor and the children’s programming moving to that space, while the first floor is renovated for use by town offices. Other building improvements also will be done, including the installation of an elevator, the replacement of windows and paving the parking lot. Those costs are not included in the $3 million price and are expected to cost another $3.7 million.

The total $6.7 million cost for the project is less than if the town were to build new, Kellogg said, which was estimated to cost between $13 million and $16 million.

Once completed, the community center is expected to be a money maker for the town, Kellogg said. Operating costs are estimated to be $100,000 to $125,000 annually, he said, while revenue is estimated at $225,000. While the Parks and Recreation Department offers free programing, many of its programs are fee-based, he said and with the additional space, those fee-based programs can expand, bringing in more money. The surplus can go toward additional programing, more free community events or can be returned to the fund balance, he said.