MONROE, CT — Money was never an issue for Angela Viteri, assistant manager of Union Savings Bank’s branch on Monroe Turnpike, until she received a reality check after having three children with her husband, Johnny.

“When I didn’t have kids, it was more of a free for all,” she said. “I would see things I wanted and I would get it. Now it’s, ‘do I need it or do I want it?'”

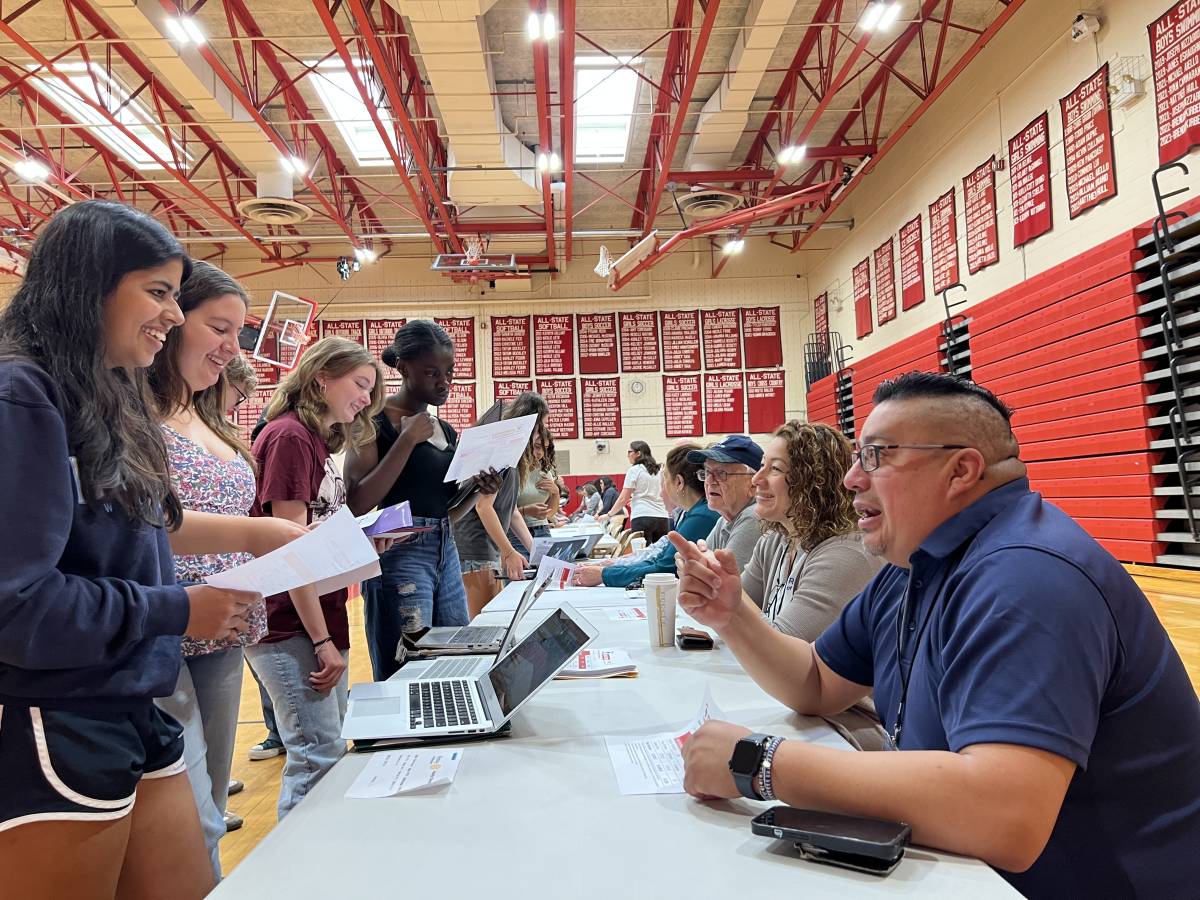

Viteri and her husband, who is employed as an interpreter for the state and has a side gig as a deejay, were among the close to 50 volunteers sharing financial knowledge gained from years of experience with nearly 200 Masuk High School students in personal finance teachers, Jonelle DiSette and Allyson Danso’s classes Tuesday morning.

Masuk hosted Reality Check, a Monroe Rotary Club sponsored event that began three years ago, when Rotarian David Wolfe patterned it after a program at the Yukon Public Schools in Oklahoma.

“It gives the kids a glimpse of reality once they leave high school and enter the ‘real world’,” Viteri said.

The program was adopted by the Trumbull Rotary Club, which held its own Reality Check at Trumbull High School after hearing about Monroe’s program. Now both clubs share volunteers at each other’s programs.

Stephanie Philips, who will be the Rotary Clubs’ district governor in 2025-26, attended Masuk’s event Tuesday.

“Oh, it’s an excellent program and it’s a program I envision every Rotary Club should emulate if they can,” Philips said, noting how the cooperation of schools is needed.

Kobza said the state legislature recently passed a new law requiring all high schools to teach personal finance. Connecticut joined 21 other states in adopting the requirement.

Opening ‘Rotaryville’

Masuk’s volunteers, who also included a number of Masuk Parent Teacher Club members, all met inside the school gym by 8:30 a.m., where there was a check in table and a spread of Dunkin’ Donuts munchkins and coffee.

Dennis Condon, a Monroe Rotarian, thanked the Dunkin’ Donuts on Monroe Turnpike for its donation.

Superintendent Joseph Kobza, who is also a Rotarian, and Monroe Rotary Club President Cindy Richter gathered everyone around in a circle for a pep talk and to give everyone their assignments.

“Have a good time,” Richter said. “The Masuk students, they’re phenomenal. They’re the nicest group of kids you’ll come across.”

Kobza shared the story of how one of his daughters got her own reality check when she had worked at a job in South Carolina. It paid $70 a day, but her paycheck was $64.

“She called us and said, ‘I have to talk to HR,'” Kobza recalled. He told his daughter the deductions were for Social Security and taxes.

“She said, ‘I didn’t sign up for that!'” Kobza said as the group erupted into laughter.

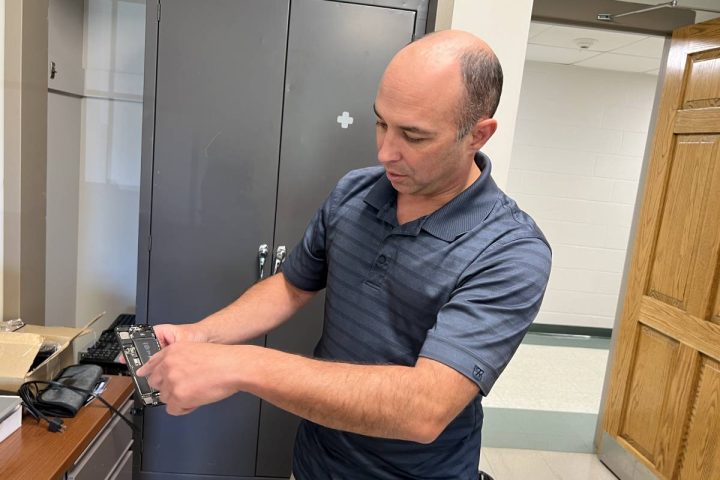

The gym was set up as the fictional town of Rotaryville and every student had a profession with its own individual salary. Tables around the room represented living expenses, from transportation, insurance and housing, to grocery shopping, entertainment and getting a credit card.

Students had to go to every table and one rotation around the room represented a month. The goal was to either break even or have money left over.

Students who overspent during the game could go to the Side Hustle table to moonlight as an Uber Driver or to find another part-time job to make ends meet.

But despite even the best of planning, life can throw you some curve balls. Each student had to take a spin of the Wheel of (Mis)Fortune, which could result in extra cash or an unanticipated expense.

Once again, Rick Smith volunteered at the Wheel, calling out the results as students lined up for a spin.

“$176! Way to go!” Smith said of one lucky spin.

The next student wasn’t so lucky.

“You broke your leg,” Smith exclaimed.

Building your credit rating

Angela and Johnny Viteri were at the Credit Card table with fellow volunteers, including Monroe Town Treasurer Frank Dutches, Cindy Richter and Stan Tait. They had a few minutes to prepare before the first wave of students came in.

“To build a credit score, they need a credit card,” Richter said, “but they need to be financially responsible.”

“To build a credit score, they need a credit card,” Richter said, “but they need to be financially responsible.”

Richter said making minimum payments does not increase a credit score. Making higher monthly payments or paying off the entire amount does, she added.

A higher credit score allows people to borrow money at lower rates.

Each volunteer had a sheet to go over with students. It showed three options to pay for a monthly balance of $1,200, including a minimum monthly payment of $38, a higher payment of $120 and paying off the entire amount.

According to the sheet, making minimum payments would pay off the $1,200 within 53 months, but the interest would nearly double the amount one would spend. The $776.81 in interest factors into a total of $1,976.81.

By paying $120 per month, the student could pay off the $1,200 in 12 months, tacking on $159.86 in interest for a total of $1,359.86.

The advantage of paying it all off at once is zero interest.

“A lot of credit cards come with reward points, so kids say, ‘I have to spend more to get more points,’ but then they owe more than they can handle,” Richter said.

“If they pay it all off, they get the points for nothing,” Dutches said.

“I had so many reward points I was able to buy one of those Bissell vacuum cleaners,” Richter said, “and I still have points left.”

The first wave

Two female students walked up to the table and Angela Viteri went over their options. “When you make minimum payments, your credit score doesn’t go up,” she explained.

Two female students walked up to the table and Angela Viteri went over their options. “When you make minimum payments, your credit score doesn’t go up,” she explained.

“What kind of jobs did you get,” she asked them with a smile.

“I’m an attorney,” one students replied.

Four more students came up and Johnny helped them. “Do you have any questions?” he asked afterward. Smiling at one girl, he said, “it looks like you have a question.” She smiled shyly and said no.

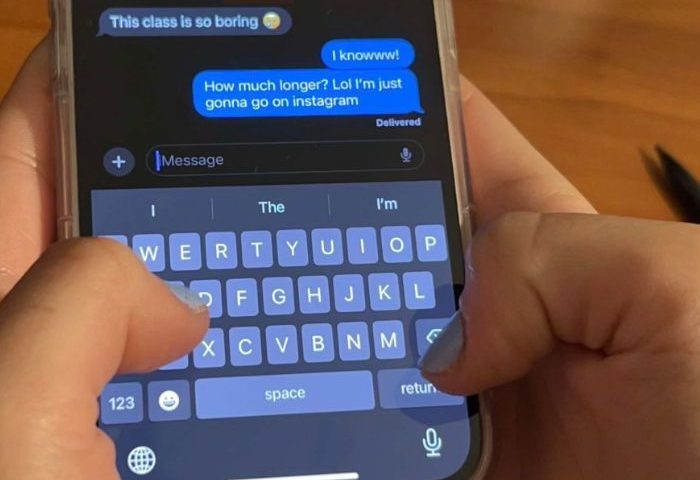

During a lull, Johnny said personal finance wasn’t taught in his high school growing up.

“I think this should be taught in school,” he said of personal finance, “because this could mess up your life if you don’t take care of this stuff.”

Angela said poor decisions early on can make it harder to buy a home or make other major purchases down the road.

When showing a group of boys the sheet, Johnny pointed to the option of paying $120 a month. “If you do this, you’ll be great,” he said. Then he pointed to the option to pay off the entire $1,200. “You do this, you’ll be awesome.”

“The middle one,” one student said.

“Yes, that’s more realistic,” Johnny said of the higher monthly payment.

“I’ll just pay it all off,” another student said.

“If you can do that, good for you,” Johnny said.

Transportation

Brendan McKeon, a funeral director, volunteered at the Transportation table with former first selectman Ken Kellogg, who is the Monroe Rotary Club’s president-elect.

“This is the first time I’ve been here,” McKeon said of volunteering for Reality Check. “I think the students are making really smart choices when it comes to transportation planning. The faculty’s done a phenomenal job preparing them for this.”

Kellogg said students’ credit scores will affect their monthly payments, and noted they will also have to pay for taxes, insurance, gas and maintenance.

McKeon said students shopping for transportation asked themselves important questions.

“I thought more kids would select the pickup truck, because it looks cool,” McKeon said of the Ford F150. “I had one kid look at the truck, but then get the Civic.”

Though students made many choices during Reality Check, some learned you can’t always get what you want.

At the Credit Card table, Johnny said, “one kid wanted to pay the whole thing off, but he couldn’t. The only option he had was to pay the minimum.”

All respectful comments with the commenter’s first and last name are welcome.