MONROE, CT — Commercial developments and renovations, a new condo complex and an increase in the number of registered vehicles are all factors Assessor Justin Feldman attributes to the growth of Monroe’s grand list.

The October 1, 2022 grand list has a net of $2,355,143,159 of taxable property, compared to $2,311,990,522 last year, a gain of $43,152,637.

First Selectman Ken Kellogg said the growth of the grand list will reduce the size of the projected tax increase from the 2023-24 budget being reviewed by town officials.

“The continued growth in Monroe’s Grand List is a clear indication of the successful efforts of the team to support and encourage responsible development,” Kellogg said. “We have made remarkable changes to simplify our organizational structure, improve procedures, streamline process, and make meaningful changes to our land use regulations.”

“I’m grateful to our staff and land use boards for their collective efforts in this regard. Monroe is clearly more business-friendly today and the proof is in our Grand List growth,” he said.

“There are a few different factors I would attribute to the growth of the Grand List that we’ve seen this past year,” Feldman said. “We’ve had contributions from a variety of commercial and industrial development projects of different scope and size.”

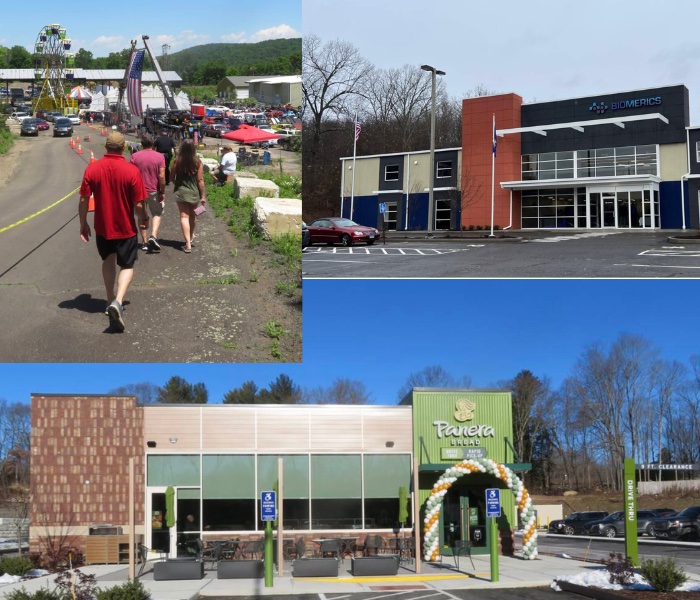

Some of the major developments that come to mind for Feldman are the new Panera Bread Café at Town Line Plaza, 205 Monroe Turnpike; the Amazon fleet of vans parking at 10 Victoria Dr.; and the revitalization of the old Stevenson Lumber site on Monroe Turnpike.

He said commercial growth has also come from businesses investing in their current facilities. For example, the major renovation of Biomerics at 246 Main St.

“In addition to their impact on real estate assessment totals, these types of projects can also generate increases to the personal property and motor vehicle components of the Grand List,” Feldman said.

Real estate values for commercial, industrial and utilities grew from $256,548,439 in 2021 to $264,320,619 or by $7,772,180 in 2022.

On the residential side, Feldman said the ongoing development of the condominium units at Cutler’s Farm Crossing also made a significant contribution to the grand list.

Overall, residential values rose from $1,692,923,905 in 2021 to $1,699,339,510 or by $6,415,605 in 2022.

“Another point worth noting is that this year’s growth to the Motor Vehicle Grand List can largely be attributed to an increase in the total number of registered vehicles, whereas last year it was primarily driven by market forces,” Feldman said.

Motor vehicle values rose from $229,128,541 in 2021 to $247,056,442 or by $17,927,901 in 2022.

Taxable personal property rose from $137,032,617 to $147,103,523 or by $10,070,906.

New development led to a $721,245 drop in land values on the grand list, falling from $23,636,565 to $22,915,320.

Owners of property depending upon their status, or specific types of property which meet certain statutory criteria are eligible to have an exemption applied to their assessment, according to Feldman.

Personal property exemptions went down by $27,279,545 in 2021 and by $25,592,255 in 2022, a $1,687,290 difference.

All respectful comments with the commenter’s first and last name are welcome.