MONROE, CT — First Selectman Ken Kellogg presented a $91.5 million town budget to the Town Council Monday night, a proposal that would raise taxes by 3.3 percent.

Town officials anticipate a challenging budget year after negotiating one-time savings from union concessions and using of a significant amount of the unassigned fund balance to keep taxes down last year, at the height of coronavirus pandemic.

“I continue to implement deliberate practices to minimize the tax burden through conservative spending and fostering growth in our grand list,” Kellogg said. “My budget proposes a municipal spending increase of 2.16 percent, which maintains services, meets our contractual obligations and ongoing increases in the costs of medical insurance, as well as the state police pension plan.”

“Furthermore, this budget includes an investment in economic development to increase our commercial grand list, so as to reduce the tax burden on our families,” he continued.

Kellogg’s budget would create an Economic and Development Department with a $96,800 budget: $85,000 for William Holsworth’s salary, $11,050 for marketing and development and $750 for office expenses.

The first selectman appointed Holsworth, a lifelong Monroe resident, to a temporary community and economic recovery coordinator position last June, to help new and existing businesses during the pandemic.

In the new position of director of community and economic development Kellogg wants Holsworth to guide Monroe’s economic growth as the town eventually moves past the pandemic.

Bringing back the referendum

The tax impact from Monroe’s last four budgets were a 1.45 percent reduction in fiscal year 2018-2019, a 0.96 percent increase in 2019-2020, a 0.28 percent decrease in 2020-2021 and a 3.31 percent increase is being proposed for 2021-2022.

If the current proposal were to pass as is, Kellogg said the four-year-average would be a tax increase of 0.63 percent, less than one percent per year.

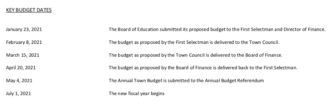

But the Town Council will now host budget workshops for the municipal budget, before the Board of Finance reviews the entire budget, so more adjustments will likely be made before a voters have the final say in a budget referendum on May 4.

Gov. Ned Lamont issued an executive order preventing municipalities from holding budget referendums last year, because of the pandemic. However, from the ongoing phone calls with the governor and his staff, Kellogg said the expectation is, if there is a new executive order, it may provide alternative actions, but not disallow a referendum.

“I continue to support the annual referendum and the voters having the final decision on our budget,” Kellogg said.

Reducing the tax impact

During the last budget process, the Board of Finance appropriated $8 million of the unassigned fund balance to avoid a big tax increase in fiscal year 2020-21 during the pandemic emergency.

“The good news is we won’t need all of it in 2021-22,” Kellogg told the Town Council. “We will continue to use a smaller amount of fund balance, which I find responsible.”

The first selectman is proposing to use $3 million of the unassigned fund balance to offset a tax increase for 2021-22.

According to his projections, Monroe’s unassigned fund balance will be above 10 percent of the total budget, which is within the Board of Finance’s recommendation of staying in the 8.33 to 16.67 percent range, with a target of 12.5 percent — enough for the town to operate for a month-and-a-half in an emergency.

There are still pending appeals from the last revaluation, but the total net taxable grand list is $2,242,728,056 with increases in values for residential and commercial real estate, motor vehicles and businesses’ personal property.

The only drop was in undeveloped land, from $25,196,320 to $24,891,220.

Kellogg said a total taxable grand list growth of $16.6 million is built into his budget proposal.

“Without our growth in the grand list, reductions in spending, and use of alternative funding, taxes would grow at an alarming rate of over 9 percent,” he said. “This budget results in a projected tax rate increase of 3.31 percent. Of the total increase in expenditures, 84 percent is attributed to education and 16 percent to municipal costs.”

A $132k cut for education

Kellogg’s proposal includes $61,791,068 for Monroe’s public schools, a 5.62 percent spending increase from the current $58.5 million education budget.

The Board of Education had asked for a 5.85 percent increase, but the first selectman said he worked closely with Superintendent of Schools Joseph Kobza and Ronald Bunovsky Jr., who serves as finance director for the school district and the town, to find $132,000 in savings.

This includes a $58,000 reduction for a legal settlement, a $41,000 contingency covered through other funds, a pension payment that came in at $4,000 less than the actuary’s estimate, and a $29,000 allocation adjustment for liability/workers compensation insurance, according to Kellogg.

On the municipal side, he is proposing a $29,742,774 budget, a 2.16 percent or $628,397 spending increase from the current $29,114,377 budget.

Key drivers for the municipal increase include $460,000 for wages and salaries, the expectation of a 10 percent increase in medical insurance rates ($202,000), and a phase-in of the employer contribution rate increase for police pensions set by the state Retirement Commission ($115,000).

The town managed to save $181,000 in debt service by not adding new bonding in 2021 and by refinancing existing debt.

Kellogg said the Building Department had a 26 percent increase in permits.

His budget would make the part-time assistant building official a full-time position to meet rising demand and help the town keep its favorable Insurance Service Office rating.

The first selectman said that cost will be offset by the revenue generated from the department’s permitting activity.

If economic development is important then it’s time to really talk to the town about what is the right program and where