MONROE, CT — Some news stories attribute the 28-year-low in mortgage applications to the “bursting housing bubble,” but Danielle Rownin, a Realtor with Keller Williams Real Estate, calls the bubble a myth.

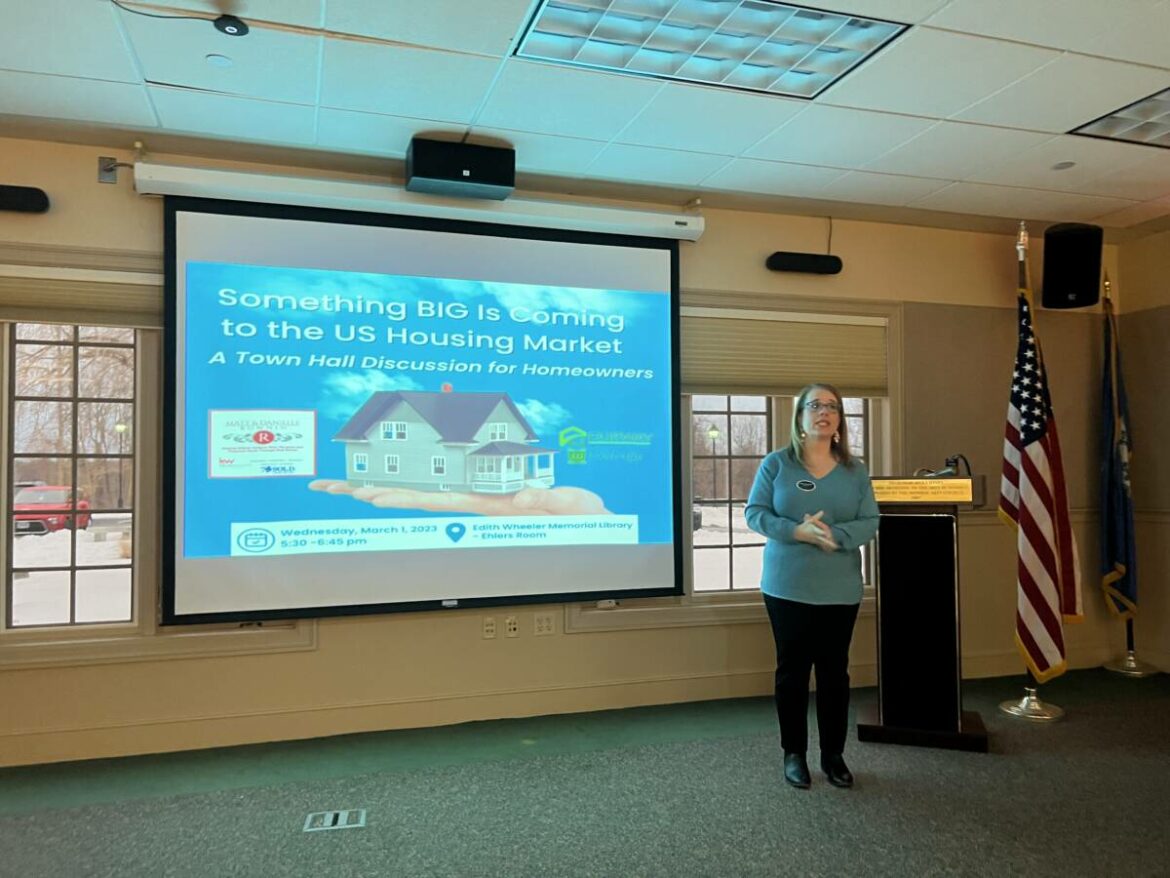

During a town hall discussion on the housing market, held in the Ehlers Room of Edith Wheeler Memorial Library last week, Rownin told her audience the quarantine amid the COVID-19 pandemic caused a slowdown in construction. Then the cost of materials rose, making builders decide to pull back.

Meanwhile, the rising trend of working from home caused a mass exodus from cities to the suburbs.

“You didn’t have to live in New York or other big cities for your corporate job, so people were able to relocate,” Rownin said. “This caused a massive housing shortage. Homebuyers were squeezed out of the market by cash buyers.”

Even those with high credit scores were no match for cash buyers, Rownin said, adding many who could borrow ended up renting instead. Soon available apartments became scarce and rental costs soared.

Close to 79,000 renters in Fairfield County can afford to buy a house or a condo, according to Rownin.

“What I really feel bad for are people who have to rent, because they can’t afford to buy,” she said. “We have a true housing shortage. There are more butts and not enough seats.”

Rownin was joined by her husband, Matt, a fellow Realtor, and Rhiannon Benedetto, a licensed loan officer with Fairway Independent Mortgage in Shelton, as presenters for the town hall event on March 1. All three are Monroe residents.

Housing market stable

According to SmartMLS Inc., 747 single family homes are for sale in Fairfield County compared to 1,997 at this time last year, a drop of 62.5 percent. Pending sales are down 31.6 percent and closed sales 52 percent.

However, the median sales price still rose from $450,000 to $535,000 or by 19 percent.

In February, Monroe had 12 active homes for sale, down 66 percent from last year (35). Pending sales were the same at 11 with four sales closed that month, a drop of 60 percent from the 10 closings in February of 2022.

Home values also increased in Monroe during the period, from a median sales price of $459,500 to $537,500, a 17-percent jump.

Rownin said rising home values is evidence that the housing market is stable and moving forward.

Adam Gitow, who attended the presentation, asked if fear is keeping some homeowners from moving.

Rownin said some of it is fear driven, with homeowners afraid to sell their home without being able to find a new place to move into, or downsizing and having to pay more for a new home with less money left over for retirement.

She said sellers can make the sale of their home contingent upon their finding a new home with a “subject to” clause. Matt Rownin said some buyers, who are emotionally attached to a home, are willing to wait if they have to.

Senior housing options

Leslie Gosselin, vice chair of the Commission for the Aging in town, was among the 12 people in attendance Wednesday evening.

“We have High Meadows, which most see as a moderately priced senior development,” she said. “Say seniors want to downsize and sell their home for $485,000. The new 55-and-older community being built on Purdy Hill Road has a starting price of $559,000.”

She said many seniors cannot afford to take out a new mortgage and pay common fees for a more expensive home.

“The issue for most seniors is, they don’t want to move out of town,” Gosselin said. “Their church is here and their friends are here.”

Danielle Rownin said they are planning another presentation with all of the housing options for seniors, as well as how to make their move safer and more comfortable.

“And more affordable,” Gosselin added.

Rising interest rates

Since the last recession, The Federal Reserve had kept interest rates at historic lows to encourage buying, while buying billions of dollars in bonds every month to stimulate the economy, according to Benedetto. But now The Fed has been raising rates to control rising inflation.

On March 17, 2022, the federal funds rate was 0.25 to 0.50 percent. From Jan. 31 to Feb. 1, it had risen from 4.50 to 4.75 percent.

The presenters said the historically low interest rates are not likely to come back, so if there is a home you want, you should buy it now and, if rates come down, see if you can refinance.

Despite higher interest rates, home values are still rising. Benedetto said those who are not moving now could decide to make the equity of their home work for them.

Among the available options are buying an investment property, making home improvements, paying off debts, or cashing out to pay for college tuition or a new car with a home equity line of credit, she said.

72Sold®

After the presentation on the current housing market Matt and Danielle Rownin talked about 72Sold®, a national company and America’s leading home selling program, according to Matt Rownin.

“It gets all buyers, puts them in a competition and sells your home within 72 hours,” he said. “It puts you in the driver’s seat.”

Danielle Rownin said the longer a home sits on the market, the least likely it is to sell for market value as buyers sense desperation and come in with lower and lower offers.

Among the strategies of 72Sold®, is to show fewer and better photos online. “We want the buyer to call us to learn more about the house,” Rownin said, adding if ads contain too many details, there is no need to call.

Buyers have to call for individual appointments for showings, so those days can be booked solid and, with the revolving door, Rownin said homebuyers will see others coming to see the house as they go (and vice versa), creating demand.

The sellers allow their agent to be present at the open house, allowing the Realtor to have conversations with potential buyers, while gauging their reactions to the house or condo.

Agents for buyers normally tell the agent for the seller that their client either wants to make an offer or is not interested without helpful detail of the why, according to Rownin. But by being present at a showing, Rownin said she can read buyers’ body language.

She could reach out to a potential buyer afterward and say, “we’re not expecting offers until Sunday, but you seem to really like this house. Do you want to make an offer?” If an offer is made, she said it won’t be a low one.

While any Realtor can try these strategies, the 72Sold® home selling program is only used by Keller Williams agents, who receive the training.

All respectful comments with the commenter’s first and last name are welcome.