Nyla Jones was hired as a psychologist and her friend, Marissa Eichler landed a job as a mechanical engineer. Eichler rented a one-bedroom apartment for $1,350 a month with utilities, but Jones found a better deal, a two-bedroom condo for $1,425, including homeowner’s insurance and property tax.

“You can get a renter and charge $700 a month for the extra bedroom,” Realtor Cathie Taylor told Jones, explaining how she could cut her monthly expense in half. “Go make some money girl!”

“See how easy that was?” Jones said, turning to her friend.

“I have privacy,” Eichler said of her apartment.

“I have privacy in my own bedroom,” Jones said, while conceding she would have to share common areas, like the kitchen and living room, with a roommate.

Eichler later opted to move out of her apartment and into Jones’ condo, so both could save on living expenses.

However, this was all a simulation.

In reality, Jones, 18, is still a Masuk High School senior, and Eichler, 17, is a junior. Taylor was serving as a volunteer, while the young women and classmates in teacher Jonelle DiSette’s personal finance class participated in Reality Check, a personal finance simulation offered by the Monroe Rotary Club.

On Tuesday morning, Rotary Club volunteers were stationed at tables along the perimeter of the Masuk gymnasium. Students lined up at booths to buy housing, insurance, transportation, gas, groceries, phones, wifi, televisions, coffee, snacks and entertainment to name a few of their expenses.

Based upon the annual salaries of their occupations, students were told how much their net monthly pay would be, minus taxes, as well as the monthly cost of their student loans.

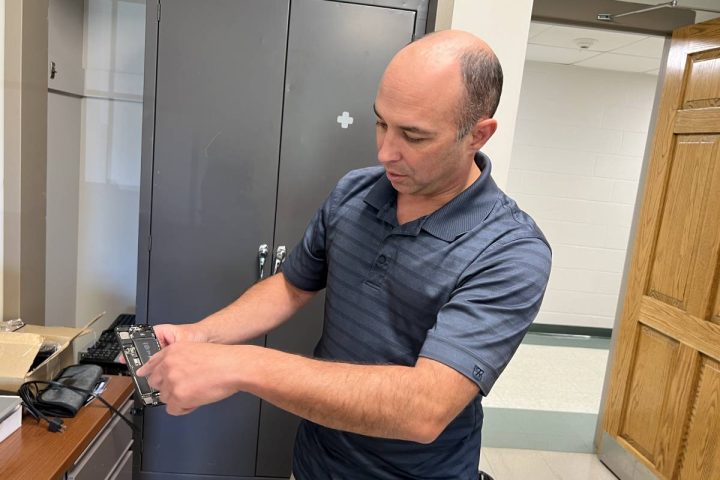

The simulation included an SOS table for students who got in over their heads and needed to add a part-time job at Amazon to supplement their incomes. Superintendent Joseph Kobza said that would bring in another $500 per month … before taxes were deducted.

Each month included a spin at The Wheel of Fortune, where students learned, no matter how careful their financial planning, life can throw you some curveballs. The result could be good or bad.

During Tuesday’s simulation, Eichler’s spin turned into a $200 graduation gift. She encouraged Jones to take a spin.

Jones, who showed a reluctance to take chances, wasn’t so lucky. Her spin resulted in a computer crash and $300 worth of repairs.

“Money isn’t everything,” Eichler told Jones.

“I can’t do charity! I can’t feed babies anymore,” Jones said, turning to her friend, “that’s on you!”

“It’s not my fault!” Eichler said continuing their joking banter.

So many choices

Dave Wolfe, a Rotary Club member, modeled Reality Check after a program at the Yukon Public Schools in Oklahoma. He proposed offering the program at Masuk with the support of Superintendent of Schools Joseph Kobza, who is also a Rotarian.

Last year was the first Reality Check at Masuk.

“I think the Rotary Club did a fantastic job putting this together two years in a row,” DiSette said. “We changed it a little bit, having the kids do it online, keeping track of their finances on a spreadsheet.”

This year, Kobza said 120 students enrolled in DiSette’s personal finance class and participation has grown so much, another section will be added next year. “We’re hiring an additional teacher next year, because this elective is so popular,” he said.

Earlier Tuesday morning, Kobza spoke to 50 volunteers before the students arrived at the gym.

He said each student would start with $2,000 in seed money, which they could have earned and/or received after college graduation. Housing, student loan information, a car, gas and insurance all had to be handled before students could visit the other booths.

Each booth offered several choices. For example, Caraluzzi’s Newtown Market, Whole Foods Market and Big Y were among the options for groceries.

Though both maintained tight budgets, Jones and Eichler stepped up to the price on food, buying groceries at Whole Foods.

“Because we’re healthy,” Eichler explained.

Alex Ambrosecchia, 17, a senior, decided to live a little, while still satisfying his sweet tooth.

“He’s spending $108 on snacks and beverages!” Jones said to Eichler. Then in a show of good natured ribbing, Jones waived her hand in front of Ambrosecchia’s face, “you have no financial …”

“You bought everything you don’t need!” Eichler said to Ambrosecchia, who laughed and said he was going to eat his candy.

Quality of life

Volunteers had scripts and Kobza encouraged them to upsell students a little bit. “You have nice highlights, you might want to get your hair done,” he said, giving an example.

The first round counted as one month and the goal was to have enough money to get a second paycheck and make it through a second month with money left over.

But there’s more to life than practical spending on things such as medical insurance and retirement planning.

Aside from entertainment, students could make donations to charity and buy a pet with options of a cat, a dog or a gerbil.

“How did you do? Did you do everything you wanted to do?” Kobza said of the desired outcome. “Because it’s also about quality of life.”

Assistant Superintendent Sheila Casinelli said, “I think it’s a great opportunity for the students to get a feel for how to budget and for all of the expenses they’re going to have to deal with on a monthly basis — that they take for granted.”

After one month, Eichler had $932 left and Ambrosecchia had $1,382.

“I like it,” Eichler said of the simulation. “I think it’s interesting to keep track of your money and stuff.” She said the biggest eye opener was the cost of housing and gas.

All respectful comments with the commenter’s first and last name are welcome.