MONROE, CT — Voters will decide on a $99.7 million town budget with a projected 1.87 percent tax increase for fiscal year 2023-24 when they participate in the referendum on Tuesday, May 2. The Board of Finance unanimously approved the final budget proposal during a special meeting at Monroe Town Hall Thursday night.

The spending plan includes $67,683,424 for education and $31,249,688 for municipal expenditures, along with $813,868 in contingency and other appropriations. Total spending would increase by $3,023,833 or 3.13 percent.

If voters approve the budget at referendum, the mill rate would rise from 36.86 to 37.55 mills. Then the new mill rate would have to be approved by a vote of the Board of Finance.

Motor vehicle values are not included in the mill rate, since the state of Connecticut made it count separately and capped it at 32.46 mills for this year and next.

During its deliberations on the budget, the Board of Finance reduced First Selectman Ken Kellogg’s proposal to use $3 million from the undesignated fund balance to offset an increase in property taxes, instead approving the use of $2.6 million.

Overall, municipal spending would increase from $30,798,410 to $31,249,688 and education spending would rise by 4.8 percent, from $64,582,666 to $67,683,424. The fiscal plan includes $5,704,066 in debt service and a $7,342,627 capital budget.

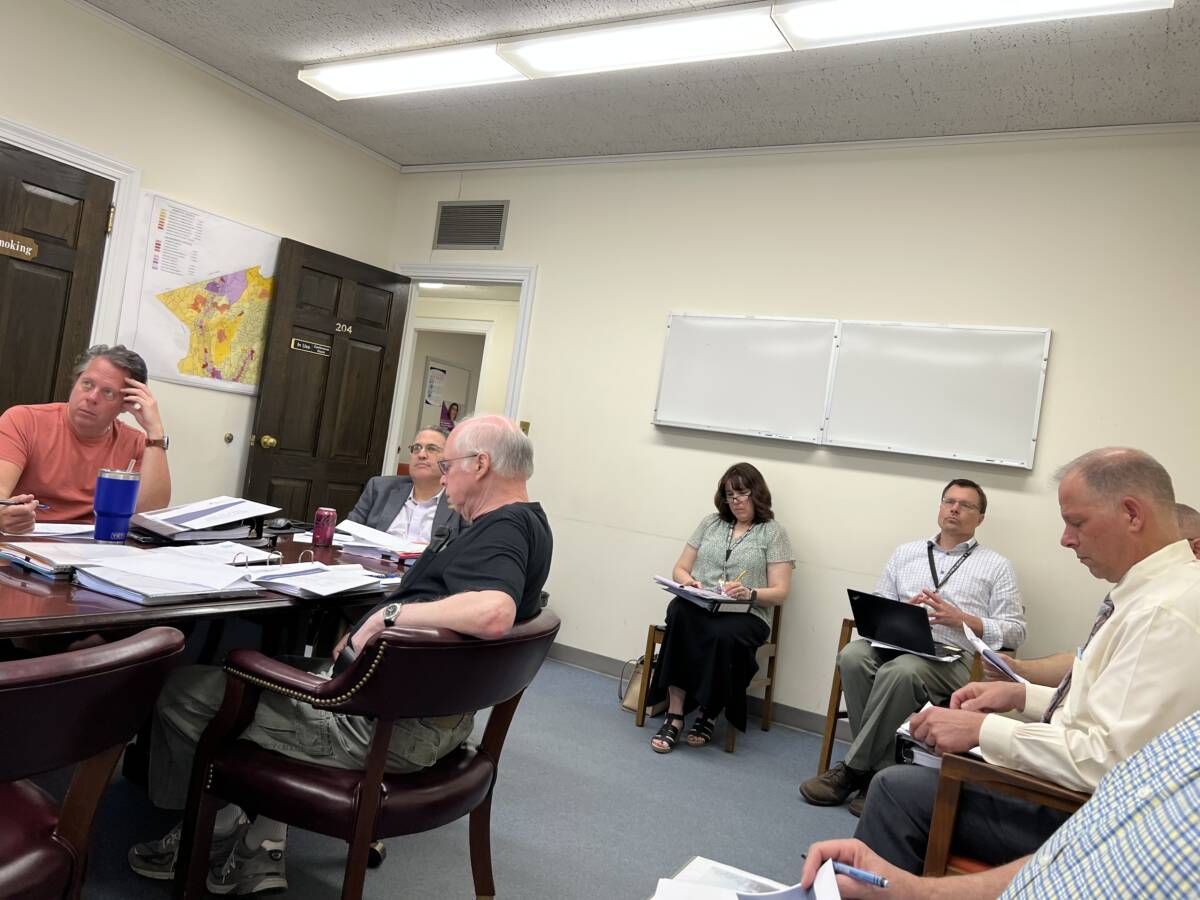

Finance board adjustments

During its budget workshops the Board of Finance made several adjustments based upon First Selectman Ken Kellogg’s recommendations.

The board increased the police pension by $70,340 due to an increase in the employer contribution rate in the state pension program. Kellogg said he had prepared his budget based upon preliminary projections.

The Actuarial Determined Employer Contribution in the Human Resources retirement plans was lower than originally projected, so the finance board reduced the line item by $110,253.

The first selectman received updated information on state aid by municipality. Though the state’s budget is not yet final, Kellogg said he spoke with State Rep. Tony Scott, R-112th, and they both anticipate the state budget will meet new grant projections.

As a result, the Board of Finance added $67,785 in intergovernmental revenue for Education Cost Sharing, $114 for Pilot and $115,002 for a motor vehicle property tax grant.

Kellogg said his budget incorporated a conservative revenue projection on interest income based on discussions with the Finance Department and Treasurer Frank Dutches. However, Dutches’ analysis shows a higher yield than what was budgeted for.

As a result, the Board of Finance increased the account for interest and dividends by $300,000.

Board of Education shortfall

The Board of Education had to approve its budget proposal first during the process, leading to unanticipated expenses when new information became available. As a result, a $141,881 deficit was already projected for fiscal year 2023-24.

Superintendent of Schools Joseph Kobza said he found $100,000 in savings, reducing the shortfall to $41,881.

Board of Finance members agreed none would have a problem with the school board using any surplus money at the end of the current budget this year to pay for things now and avoid a deficit next year.

All respectful comments with the commenter’s first and last name are welcome.