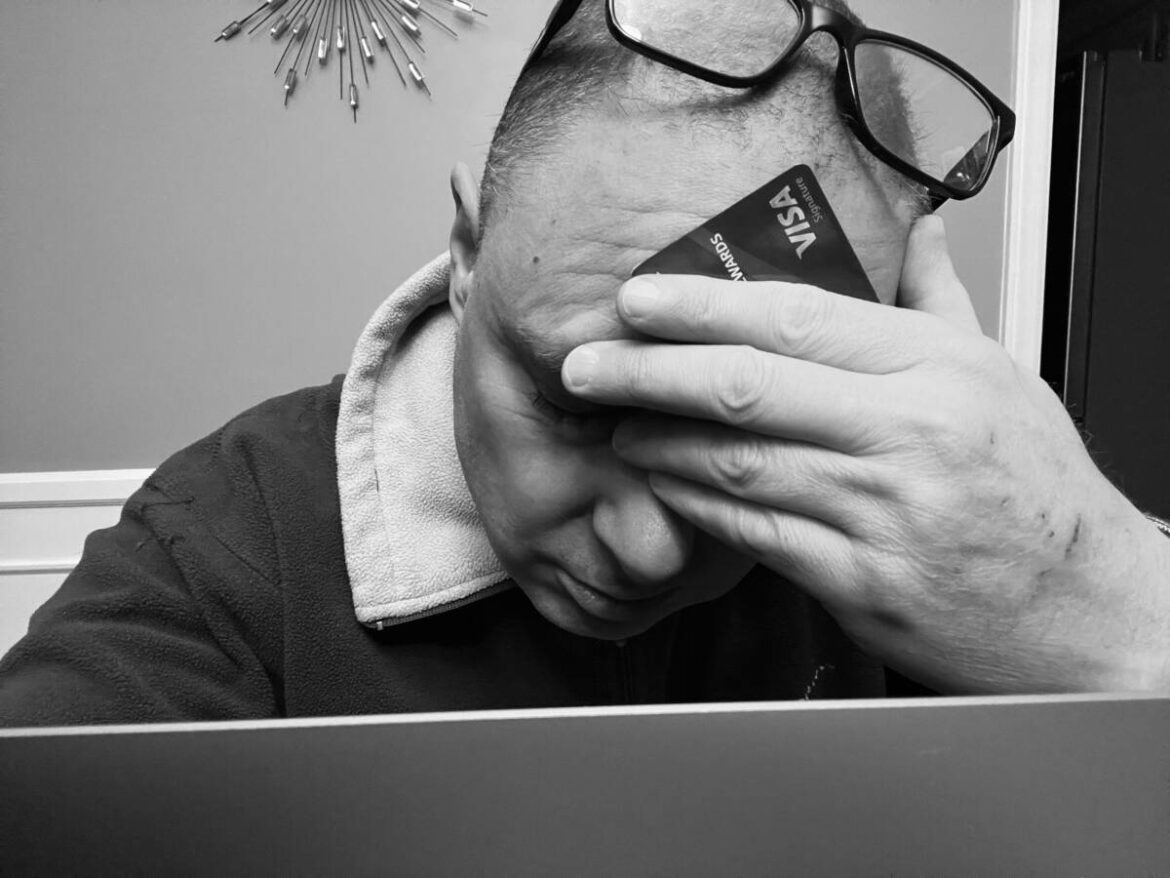

MONROE, CT — Town police received seven complaints of bogus unemployment benefit claims between Tuesday and Thursday. The Connecticut Department of Labor shared a link to its web page with The Sun on ways to prevent fraud.

The department also shared a press release urging residents to beware of text messaging scams. Below is information taken directly from that article and the Labor Department’s website.

“Everyone must stay vigilant about identity theft and fraud,” said Danté Bartolomeo, the CTDOL commissioner. “Something as simple as posting on social media that you have questions about your unemployment benefits or having problems filing is enough information to help criminals hijack your identity. Be fraud aware. Always.”

Bartolomeo said the Labor Department does not handle unemployment claims over text, adding the best way to check the status of your account is by navigating the ReEmployCT pages on the CTDOL website.

Those with questions about their account, should call the Consumer Contact Center, according to Bartolomeo. Call center hours are Monday through Friday from 7:30 a.m. to 4:30 p.m. The numbers are (203) 941-6868, (860) 967-0493, (800) 956-3294 and TTY – 711 or (800) 842-9710.

She said common phishing themes include texts urging people to log into illegitimate links; texts that threaten to withhold weekly benefits until an account is validated; and texts notifying users a change has been made to their unemployment account.

All of these fraudulent texts contain a link to websites that may look similar to, but are not, CTDOL pages. Filers should use best practices to keep their accounts safe. Visit the CTDOL fraud page for additional information or call the Consumer Contact Center for assistance.

Protect your identity

Aside from texts, criminals can steal your information using social media, through email, and by breaching retail and commercial systems that have customers’ personal identifiers like birth dates, Social Security numbers, and other details.

Many people don’t realize they are a victim of identity theft until they start getting the bills; in some cases, that notification may be from the Connecticut Department of Labor in the form of a monetary determination letter or a 1099 tax form.

Did you receive a 1099 form or monetary determination letter? Submit the CTDOL ID Theft Report Form immediately.

When criminals file for unemployment benefits using a stolen identity, it can take time to unravel what happened. Many identity theft protection programs only flag issues for their customers if the issue is related to credit and banking.

An individual who has an identity protection service will not be notified if their identity is used to claim unemployment benefits because this system is separate from the banking system. Here’s what we know and some tips to help if it happens to you:

How did they get my info?

Personal information is available to criminals — they purchase it on the dark web, obtain it through retail and commercial breaches, and get you to reveal it through text, phone, social media, and email phishing.

Have you ever received one of those “fun” surveys on social media that will reveal your personality type if you answer a few questions about your favorite color, first pet or childhood best friend? These can be scams designed to get you to reveal the answers to common security questions. Don’t participate in these no matter where they originated.

If you get a scam text, report it to your carrier. Forward the message to 7726 (SPAM). This works for all major mobile carriers.

CTDOL will never:

- Call you and ask you for your account username or password.

- Do individual unemployment claims work over text.

- Use social media for claims work. We never ask for identifying information, photos, or documents through social media. Our social media platforms are for information only.

Beware of:

- Text and email scams. Do not click on any links or attachments. Check URLs carefully to ensure an exact match with CTDOL web resources. If you have a question, always navigate to your unemployment account through ReEmployCT or call the Consumer Contact Center. If you get a scam text, report it to your carrier. Forward it to 7726 (SPAM). This works for all major mobile companies.

- Social media scams. If someone offers to help you with your unemployment claim, do not accept. Only CTDOL Consumer Contact Center staff have access to your claims information. The application for unemployment benefits contains personal identifiers; if someone helps you with the application, they have your information.

Examples of phishing and fraud texts:

Not a CTDOL URL

CTDOL has ‘ct.gov’ extensions, not ct-gov.com.

Notify us immediately using the CTDOL ID Theft Report Form if any of the below happen:

- Information requests. If CTDOL requests information from you or your employer, an imposter claim may have been filed with us indicating you may be a victim of identity theft.

- You receive a monetary determination letter.

- You receive 1009 tax form.

- Unexpected payments. If you receive unexpected unemployment benefits, you may be a victim of unemployment fraud.

Avoid being a victim

Cyber security experts recommend regular account maintenance to maintain the integrity and security of your personal information. The information available on the dark web is only as good as it is current. Update what you can — passwords (and don’t repeat passwords) and usernames, and don’t share them with anyone.

Best practices include:

- Use different passwords for your social media, banking, email, and other accounts.

- Change your passwords regularly.

- Use strong passwords — upper and lowercase letters, symbols, possibly a short phrase in lieu of a single word, and stay away from dictionary words.

- Use two-factor authentication to access your accounts whenever possible.

- Monitor your accounts — if you had an email breach, other accounts may also be compromised.

- If you receive a message via text or email and it seems suspicious, do not reply to the message, instead, independently search out the contact information for the organization so you can confirm the communication.

- Check credit card fraud protection services. Many of them will monitor the dark web as part of standard identity theft protection.

- Trust your instincts. If something seems wrong, take a deeper dive to keep your personal information protected.

If you are a victim of I.D. theft

- Submit the CTDOL ID Theft Report Form immediately.

- File a police report with your local police department. Obtain a copy of the report that you can provide to creditors and credit agencies.

- Change passwords on your email, banking, and other personal accounts.

- Make a list of credit card companies, banks, and other financial institutions where you do business. Tell them you are a victim of identity theft, and ask them to put a fraud alert on your account.

- Get a copy of your credit report and dispute any fraudulent transactions. Check that all the accounts that are open are yours. You can request credit reports online from the 3 major credit reporting agencies:

- Equifax: 800-349-9960 or freeze your credit online

- Experian: 888-397-3742 or freeze your credit online

- TransUnion: 888-909-8872 or freeze your credit online

- Place a credit freeze with each of the 3 major credit reporting agencies by calling the agencies or freezing your credit online.

- Place a fraud alert on your credit file. You can do this by contacting just one of the credit agencies to add an alert with all three agencies.

Who can help:

CTDOL’s Integrity Unit can assist if someone has submitted an unemployment application in your name. Submit the ID Theft Report Form immediately.

- If you suspect that someone is using your Social Security Number for work purposes, contact the Social Security Administration at 800-772-1213 to report the problem.

- They will review your earnings with you to ensure they are correct. You can also review earnings posted to your social security statement for workers 18 and older.

- The US Department of Justice National Center for Disaster Fraud (NCDF) has an ID theft complaint form.

- File a complaint with the Federal Trade Commission (FTC). You can also call FTC at 877-ID-THEFT.

- Opt-in to the IRS’ Identity Protection PIN program. Through this program, the IRS will issue you a 6-digit IP PIN. The IRS will then use this pin to verify your identity and keep scammers from using your identity to file illegitimate tax returns.

Fraud alerts

Help us protect you by being vigilant about account security.

View public fraud alerts on the US Department of Justice’s Unemployment Insurance Fraud page.