MONROE, CT — Rising inflation impacts taxpayers and businesses alike, and First Selectman Ken Kellogg said the current economic climate also affects towns and cities as the costs for services, labor, equipment and utilities spike.

“I do have to stress that we’re not immune to the same pressures from price increases,” he said.

On Monday night, Kellogg presented a $99.86 million town budget proposal to the Town Council during its meeting.

“In preparing my fiscal year 2024 budget proposal, I remained committed to controlling taxes while improving roads and infrastructure, delivering cost-effective services to our community, providing excellence in education, and maintaining the strong financial health of the town,” he said.

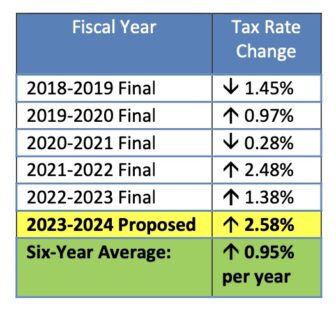

Though spending would increase by 3.25 percent, the first selectman recommends using $3 million of the undesignated fund balance to offset personal property taxes, reducing the projected tax increase to 2.58 percent.

Though spending would increase by 3.25 percent, the first selectman recommends using $3 million of the undesignated fund balance to offset personal property taxes, reducing the projected tax increase to 2.58 percent.

If the budget proposal were to pass as is, Kellogg said the town’s six-year average tax increase would still be below one percent at 0.95 percent per year.

The $99,865,113 town budget proposal includes $67,683,424 for Monroe’s public schools and $31,367,821 for municipal costs. It would be $3,141,966 more than the current $96.7 million budget.

The Town Council will review the municipal budget, then the Board of Finance will review the entire town budget, so the numbers may change before a final proposal is decided on by voters at the referendum on May 2.

Kellogg said a $43 million net increase in the grand list provided significant help in reducing the size of the projected tax increase. The October 1, 2022 grand list shows a net of $2,355,143,159 in taxable property values.

A projected undesignated fund balance of $20 million is the highest on record, accounting for about 20 percent of total expenditures, while far exceeding the Board of Finance’s recommended range of 8.3 to 16.7 percent, according to Kellogg.

Kellogg said the “extremely healthy” fund balance allows officials to use a portion of it to offset taxes without it being too low.

He said the Board of Finance is working on a three-year budget model, which includes managing the fund balance in a way to avoid the “fiscal cliff” of a high tax increase in one year.

A cut for education

The first selectman cut the Board of Education’s request by $475,000, reducing the spending increase for education from 5.77 to 4.8 percent.

Board of Education members spoke of using grant funds to reduce the board’s request. Kellogg said he factored available grant funds in when deciding on the $475,000 reduction.

“I proudly support Monroe’s award-winning, robust educational system that is highly valued by our community,” Kellogg said. “Without question, Monroe Public Schools is the greatest driver of the town’s overall budget, representing 68 percent of total expenditures.”

“Our Board of Education has requested a 5.77% increase, which creates significant challenges in continuing to deliver a budget that does not result in a substantial increase in property taxes,” he said.

In Kellogg’s proposal, the current $64,582,666 education budget would increase by $3,100,758 to $67,683,424.

Finding efficiencies

The $31,367,821 municipal budget proposal is a $569,411 or a 1.85 percent increase over the current $30,798,410 spending plan.

“I have worked with department heads to identify cost containment strategies wherever possible and to propose a fiscally responsible budget, adjusted to incorporate due diligence and use of grants,” Kellogg said.

In the process, the first selectman said some departmental efficiencies were found.

For example, Kellogg said parks and recreation maintainers already work closely with public works and are in the same union as public works employees.

They maintain the grounds at Wolfe Park, the Monroe Senior Center, Monroe Town Hall, Edith Wheeler Memorial Library, firehouses, Webb Mountain, the roundabout and Stepney Green, and provide snow removal for those properties.

“I’m proposing to shift this maintenance into the Parks and Recreation Department,” Kellogg said.

He also proposes rolling supervisor positions at the Parks and Recreation and Public Works departments into one position, a general foreman who will oversee all staff and report to the deputy director of public works.

This would provide more organizational efficiency, while saving $79,000 in salaries, according to Kellogg, who said he will present this plan to the Town Council as a department reorganization and discuss it in more detail with union representatives and the Parks and Recreation Commission.

In another proposed change, Town Planner Rick Schultz would become the planning and zoning administrator and the town planner position would be eliminated.

In the past, Kellogg said Monroe had a planning and zoning administrator without a town planner.

The first selectman said this change would be “in line with with best practices by keeping permitting processes in the same group.”

Kellogg also proposes having Planning and Zoning and Building departments report to Community and Economic Development Director William Holsworth, and for a part-time special projects coordinator to be hired.

Kellogg said this reshuffling would result in a net savings of $43,000, while eliminating over $20,000 in benefits from the town planner position.

In other recent reorganizations, engineering is now part of public works and there is one enforcement officer for both wetlands and zoning.