To the Editor:

Democrat Nick Kapoor says he’s supporting increased local property taxes next year because of the pandemic, but Nick’s always supported tax increases. His support for the 8.9% teacher salary increase was pre-pandemic as was his support for the 5.7% BOE increase proposed pre-pandemic by a Superintendent the BOE then placed on administrative leave.

His statements on increasing your property taxes are a matter of public record. While his record of being a tax and spend advocate is scary, it certainly isn’t a scare tactic.

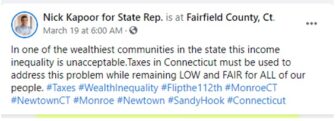

Democrats in Connecticut have run this state for decades. Our state ranking of 5th highest tax burden in America is a fact as is their control of all state wide taxation and spending policies. As a candidate Kapoor boasts on his website that “Income inequality is unacceptable.” And that “Taxes must be used to address this problem.” When called out on his latest taxation scheme Kapoor states that he will, “fight against new taxes including any type of income equality tax.”

Democrats in Connecticut have run this state for decades. Our state ranking of 5th highest tax burden in America is a fact as is their control of all state wide taxation and spending policies. As a candidate Kapoor boasts on his website that “Income inequality is unacceptable.” And that “Taxes must be used to address this problem.” When called out on his latest taxation scheme Kapoor states that he will, “fight against new taxes including any type of income equality tax.”

So how does Kapoor plan to keep his promise of opposing new taxes while paying for income inequality?

Perhaps he doesn’t think raising existing taxes to fund new expenses counts as new taxes?

Kapoor’s public record in Monroe shows a clear history of raising your local property tax. That’s a fact.

Patrick O’Hara

57 Year Resident and Town Treasurer

One of Monroe’s giant potholes claimed yet another tire of mine yesterday and I also paid my town tax bill, so taxes are on my mind. It’d be nice to hear the Republican party’s suggestions on how to reduce the tax burden other than regurgitating more rhetoric. The local Republicans have a long record of gladly raising local taxes while blaming others for it. So what is Scott’s plan if he’s supposed to be any better? I’ve honestly been looking but can’t find any specifics and you didn’t mention any here. Where is “the only authentic candidate’s” plan you’re defending?

Couldn’t have said it any better myself